Uglė social security and other taxes payments and debts

Uglė, IĮ debt to Juris LT – NONE

2025-11-18 data shows that Uglė, IĮ has no debt to Juris LT, UAB.

Information not accurate? Contact us!Uglė (legal entity code 300038363) had no overdue tax payments to the STATE TAX INSPECTORATE (VMI) as of the beginning of 2025-11-18.

Only 45 Eur

Uglė (SS insurer code 698865, company code 300038363) as of 2025-11-17 have no social security debts.

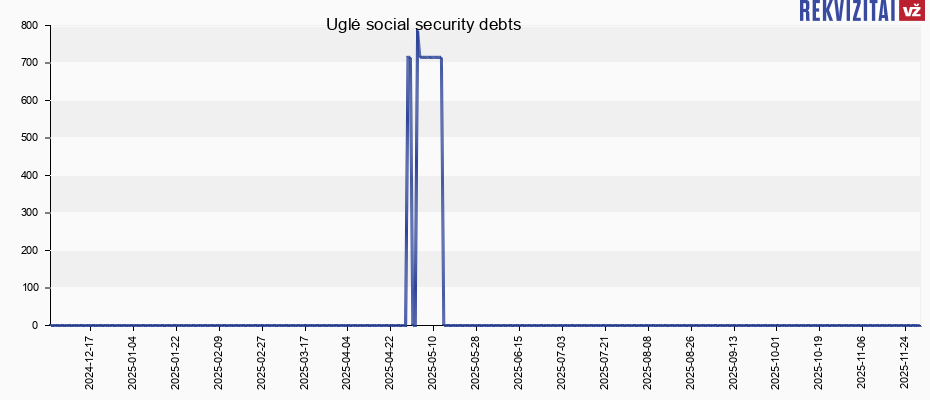

History of social security payments and liabilities:

History of social security payments and liabilities:

- from 2025-05-14 to 2025-11-17 no social security debts were recorded

- from 2025-05-04 there has been a social security debt of 715.07 EUR

- from 2025-05-03 there has been a social security debt of 787.52 EUR

- from 2025-05-01 no social security debts were recorded

- from 2025-04-29 there has been a social security debt of 715.07 EUR

- from 2024-04-11 no social security debts were recorded

- from 2024-04-03 there has been a social security debt of 999.60 EUR

- from 2024-03-18 there has been a social security debt of 935.10 EUR

- from 2023-04-20 no social security debts were recorded

- from 2023-04-18 there has been a social security debt of 1042.88 EUR

- ...

- from 2023-03-20 there has been a social security debt of 1042.88 EUR

- from 2022-03-29 no social security debts were recorded

- from 2022-03-22 there has been a social security debt of 387.95 EUR

Social security debt is the sum payable to the budget of the State Social Insurance Fund by the insured party, encompassing contributions, fines, late payment penalties, and interest. This amount is calculated by adding the delayed debt to the sum that, according to legislation, should have been paid two working days before the day of public disclosure. It includes the deferred debt amount and excludes the sums credited and written off by the State Social Insurance Fund administration institutions, considering the payments made by the insured party. The displayed debts belong to companies that were in arrears two working days before the data formation day.

Data on the debts of insured parties are updated on working days, excluding the first working day following a non-working (holiday) day. The data are also updated on the first non-working (holiday) day following a working day. The source of the data is the State Social Insurance Fund Board under the Ministry of Social Security and Labour.

Only 45 Eur

Sell your debt to professionals

Sell your debt to professionals

State Tax Inspectorate

State Tax Inspectorate