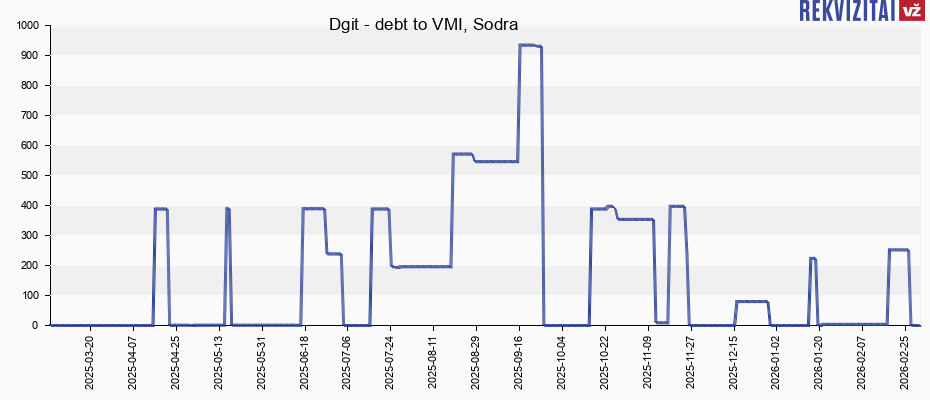

Dgit social security and other taxes payments and debts

Dgit, UAB debt to Juris LT – NONE

2026-01-24 data shows that Dgit, UAB has no debt to Juris LT, UAB.

Dgit (legal entity code 306274840) as of the beginning of 2026-01-01 had an amount of 0,23 Eur of overdue tax payments to the STATE TAX INSPECTORATE (VMI).

Change in overdue tax arrears:

Change in overdue tax arrears:

- from 2026-01-01 had 0,23 Eur of overdue tax arrears

- from 2025-10-08 had no overdue tax arrears

- from 2025-10-04 had 0,05 Eur of overdue tax arrears

- from 2025-10-02 had 36,68 Eur of overdue tax arrears

- from 2025-09-28 had 36,62 Eur of overdue tax arrears

- from 2025-09-27 had 0,62 Eur of overdue tax arrears

- from 2025-09-26 had 36,18 Eur of overdue tax arrears

- from 2025-09-25 had 36,05 Eur of overdue tax arrears

- from 2025-09-14 had 36,29 Eur of overdue tax arrears

- from 2025-09-01 had 36,17 Eur of overdue tax arrears

- ...

- from 2024-04-18 had 179,76 Eur of overdue tax arrears

- from 2024-04-12 had 177,26 Eur of overdue tax arrears

- from 2024-04-06 had 1,02 Eur of overdue tax arrears

The data in this section is about legal entities with tax debt, specificaly indicating (excluding executive documents):

• overdue arrears (total amount of the company's overdue tax arrears),

• deferred overdue arrears (according to tax loan agreement, aid agreement, restructuring plan, solvency recovery plan, settlement agreement, overdue amount).

The data are updated every night from the State Open Data Portal, where they are received from the Tax Accounting Information System on the non-surcharge of a specific legal entity payer.

Only 45 Eur

Dgit (SS insurer code 4077622, company code 306274840) as of 2026-01-22 there is a social security debt of 3,79 Eur.

History of social security payments and liabilities:

History of social security payments and liabilities:

- from 2026-01-21 to 2026-01-22 there has been a social security debt of 3,79 Eur

- from 2026-01-19 no social security debts were recorded

- from 2026-01-16 there has been a social security debt of 223,78 Eur

- from 2025-12-30 no social security debts were recorded

- from 2025-12-16 there has been a social security debt of 79,76 Eur

- from 2025-11-26 no social security debts were recorded

- from 2025-11-25 there has been a social security debt of 244,30 Eur

- from 2025-11-18 there has been a social security debt of 397,22 Eur

- from 2025-11-12 there has been a social security debt of 8,90 Eur

- from 2025-10-27 there has been a social security debt of 353,66 Eur

- ...

- from 2023-09-18 there has been a social security debt of 205,08 Eur

- from 2023-08-21 no social security debts were recorded

- from 2023-07-24 there has been a social security debt of 0,06 Eur

Social security debt is the sum payable to the budget of the State Social Insurance Fund by the insured party, encompassing contributions, fines, late payment penalties, and interest. This amount is calculated by adding the delayed debt to the sum that, according to legislation, should have been paid two working days before the day of public disclosure. It includes the deferred debt amount and excludes the sums credited and written off by the State Social Insurance Fund administration institutions, considering the payments made by the insured party. The displayed debts belong to companies that were in arrears two working days before the data formation day.

Data on the debts of insured parties are updated on working days, excluding the first working day following a non-working (holiday) day. The data are also updated on the first non-working (holiday) day following a working day. The source of the data is the State Social Insurance Fund Board under the Ministry of Social Security and Labour.

Only 45 Eur

Sell your debt to professionals

Sell your debt to professionals

State Tax Inspectorate

State Tax Inspectorate